If you want to know how to do a gst number search, you are in the right place. Many people find it hard to check the GST details of a business online. With the gst number search tool, you can easily find full details about any business or company registered under GST in India. It helps you confirm if a business is genuine or fake. You just need the GSTIN (Goods and Services Tax Identification Number) to search, and within seconds, you can see all the business details. This process is free, fast, and safe for everyone to use.

Doing a gst number search is not only helpful for buyers but also important for sellers, shop owners, and service providers. It helps you stay updated with tax rules and avoid fake GST numbers. By checking GST details online, you can see the name of the business, type of business, registration date, and more. The GST portal is the official site where you can do this. In this blog, you will learn how to search GST numbers online, what information you can find, and why it is important for every business owner and customer to know about it. Let’s start learning this simple process step by step.

Table of Contents

What Is GST Number Search and Why It Matters

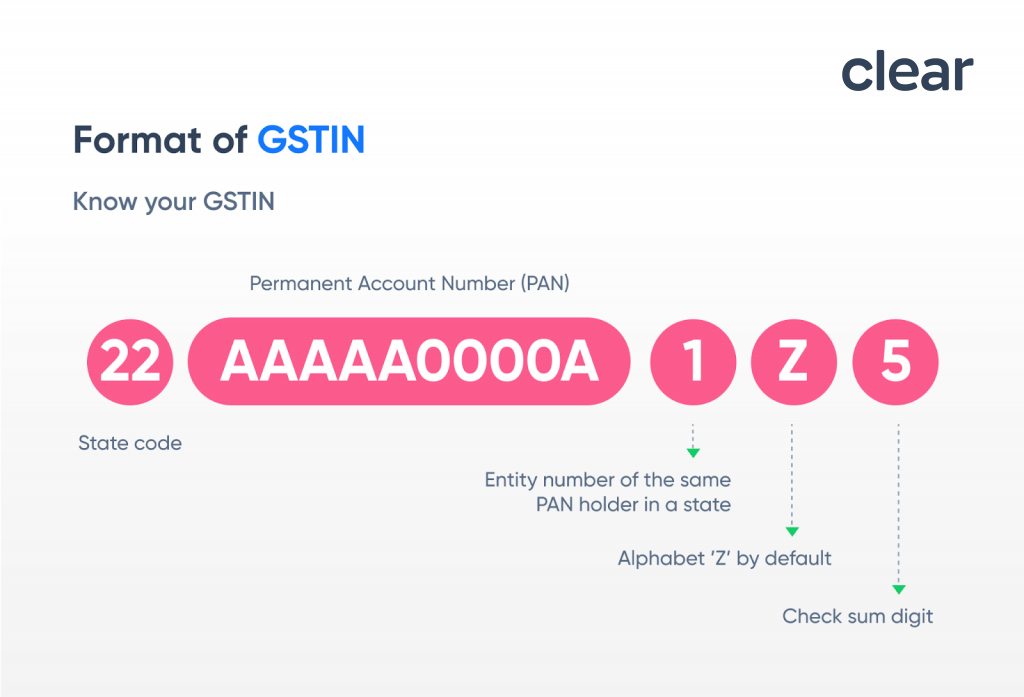

A gst number search is an easy online way to check if a business or company is registered under the Goods and Services Tax (GST) system in India. Every registered business gets a unique 15-digit GSTIN, which shows details like the business name, state code, and PAN number. Using gst number search, you can find these details quickly.

This tool is very helpful for customers, shopkeepers, and business owners. It helps confirm if a business is real and paying taxes properly. Doing this search saves you from fake sellers or companies using false GST numbers. In short, gst number search is an easy and smart way to build trust in any business transaction.

Step-by-Step Guide to Do GST Number Search Online

Doing a gst number search online is simple. You just need an internet connection and the GSTIN of the business. Here’s how to do it:

- Go to the official GST portal – https://www.gst.gov.in/

- On the homepage, find and click “Search Taxpayer.”

- You will see options to search by GSTIN/UIN, PAN, or Business Name.

- Enter the GSTIN or other details in the box.

- Fill in the captcha and click “Search.”

In just a few seconds, you will get all details about the business, such as legal name, trade name, state, date of registration, and GST status. This is the most trusted and safe way to do a gst number search.

How to Use GST Portal for GST Number Search

The GST portal is the official website made by the Government of India. It allows users to do many things like filing returns, paying taxes, and checking GST details. The gst number search tool on this website helps you verify any GST-registered business easily.

When you search on the GST portal, it shows all details linked to the GSTIN. You can even check if the business is active or canceled. This is very important because some businesses close their GST accounts, but people still use the old numbers. So, always check the GST status before making any business deal.

Details You Can Find Through GST Number Search

When you do a gst number search, you get many useful details about a business. These include:

- Legal name of the business

- Trade name (if available)

- State and district of registration

- Date of registration

- Type of taxpayer (regular, composition, etc.)

- GST status (active or canceled)

- Business constitution (company, partnership, individual, etc.)

All these details help you understand if the business is genuine and if you can safely deal with it.

Benefits of Doing GST Number Search Before Business Deals

Doing a gst number search before making any business deal is very useful. It gives you confidence that you are working with a legal and registered company. Here are a few main benefits:

- Verify authenticity: Check if the business is real and properly registered.

- Avoid fraud: Many fake companies use false GST numbers. Searching helps stop such scams.

- Save money: Wrong GST numbers can cause billing and tax problems.

- Stay compliant: Helps businesses and customers follow the law properly.

In short, this small step can protect your money and keep you safe from fake sellers.

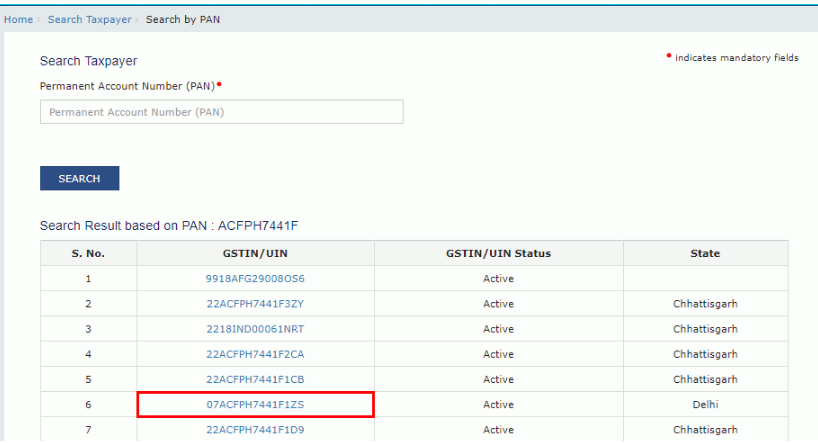

How to Find GST Number by PAN or Business Name

If you don’t have the GST number, you can still find it using the PAN or business name. Follow these steps:

- Visit the GST portal and go to the “Search Taxpayer” option.

- Choose the “Search by PAN” or “Search by Business Name” option.

- Enter the PAN number or business name correctly.

- Type the captcha and click “Search.”

You will see the list of GSTINs linked to that business or PAN. This method is helpful when you know the company name but not their GST number.

Common Problems People Face During GST Number Search

Sometimes, users face small issues while doing gst number search. The common problems include:

- Wrong GSTIN entered: Even one wrong digit can show “No Record Found.”

- Inactive or canceled GSTIN: If the business closed or stopped GST registration, the number may not show details.

- Website loading issue: The GST portal sometimes gets slow due to heavy traffic.

- Fake GSTIN shared: Always verify from the official site, not from unknown sources.

If you face such issues, try again later or double-check the GSTIN you entered.

Tips to Stay Safe from Fake GST Numbers

Fake GST numbers are sometimes used by scammers to cheat people. Here are a few safety tips:

- Always use the official GST portal for gst number search.

- Do not trust screenshots or printouts of GST numbers.

- Verify the GST status (Active/Inactive) every time.

- Check the business name carefully – even small spelling changes can indicate fraud.

- Avoid making payments until you confirm the GST details.

Being alert can save you from scams and fake bills.

Mobile Apps and Tools for Easy GST Number Search

Besides the GST portal, you can use government-approved mobile apps for quick gst number search. Some popular apps available on Google Play Store and Apple App Store allow you to:

- Search GSTINs instantly.

- Scan QR codes on GST invoices.

- Check business details anytime, anywhere.

However, always make sure the app is trusted and safe before downloading. Never enter sensitive details on unknown apps.

Conclusion

Doing a gst number search is one of the simplest ways to verify any business in India. It helps both customers and business owners stay safe, transparent, and legal. Whether you are buying a product, paying for a service, or checking a supplier, always take a few seconds to check their GST details online. It’s quick, free, and very important for trust and safety.

FAQs

Q1. What is a GST number search?

A GST number search helps you check the registration details of any GST-registered business in India using its 15-digit GSTIN.

Q2. Is gst number search free?

Yes, it is 100% free. You can check details anytime on the official GST portal.

Q3. Can I search GST number by business name?

Yes, you can search by business name or PAN if you don’t have the GSTIN.