Bito dividend history gives investors a clear look at how Bito has shared profits over time. If you are curious about whether Bito pays regular dividends or how much it has given in the past, understanding its dividend history can help you make smarter decisions. Many people check the dividend history before buying stocks or ETFs because it shows the reliability and growth potential of an investment. Bito’s dividends reflect its financial health and the company’s commitment to returning value to its shareholders. By studying the patterns in the bito dividend history, you can see when dividends were paid, how often they increased, and any special payouts that occurred over the years. This knowledge can help investors plan for long-term income and understand how Bito rewards its shareholders.

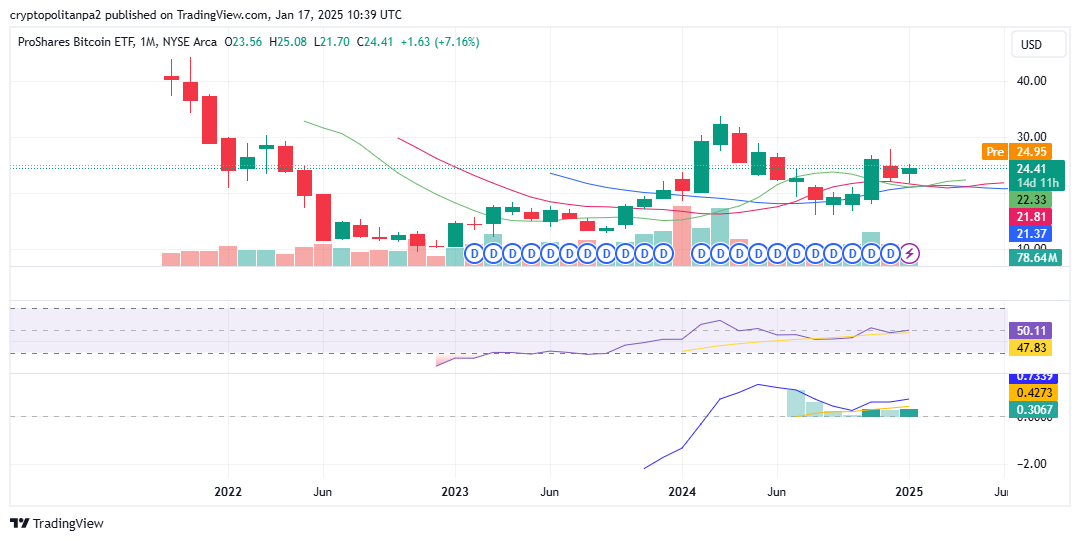

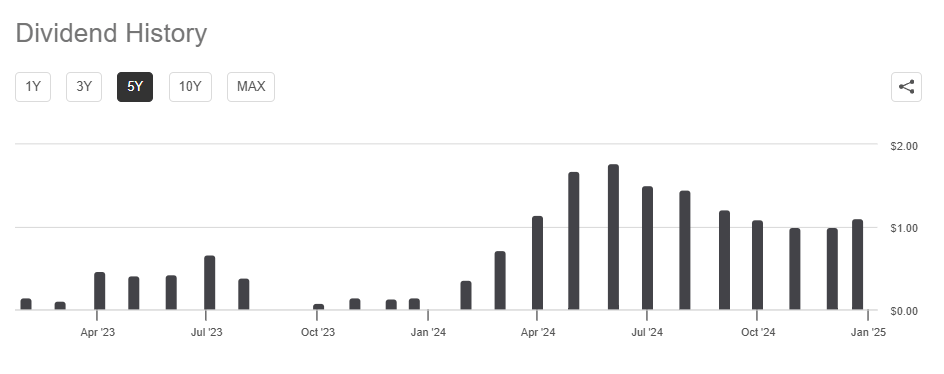

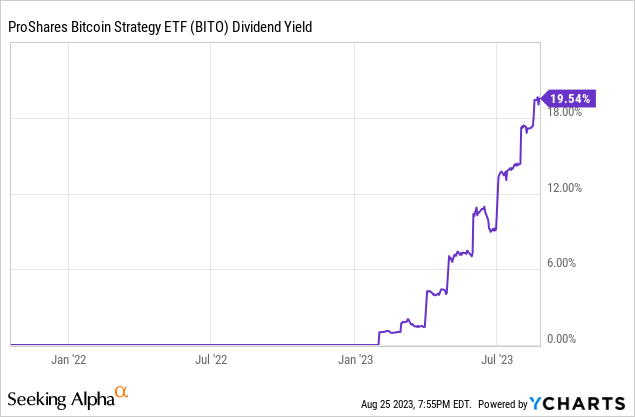

Looking at Bito dividend history closely also shows some interesting trends. Over the past few years, the company has maintained a certain payout pattern, sometimes increasing dividends when profits grew and occasionally pausing when market conditions were tough. Understanding these trends can help investors predict future dividends, although past performance is not a guarantee of future results. Bito dividend history also highlights the timing of payouts, showing whether dividends are seasonal, annual, or irregular. Many investors look at this information to estimate potential income and compare Bito to other investment options. By learning from the bito dividend history, you can better understand how consistent the company is in rewarding its shareholders, making it easier to decide if it fits your investment goals and risk level.

Table of Contents

Bito Dividend History: A Complete Guide for Investors

Investors who want steady income from their investments often look at dividend history. Bito dividend history shows how Bito has shared profits with shareholders over time. This information is important because it helps investors understand the company’s reliability and financial health. By checking Bito dividend history, you can see when dividends were paid, how much they were, and whether the company has increased payouts over the years. Learning about Bito dividend history is helpful for anyone who wants to make smart long-term investment choices.

Bito dividend history also reveals patterns in payouts. Some years may have higher dividends due to strong profits, while other years may show lower or no dividends if the market was tough. Understanding these trends can guide investors in planning future income. Bito’s dividend history can also help compare it with other similar investments, allowing investors to pick options that fit their goals. By studying Bito dividend history, investors get a clearer picture of how the company values its shareholders.

What Is Bito Dividend History?

Bito dividend history is a record of all the dividends that Bito has paid to its shareholders. Dividends are portions of a company’s profit shared with investors. Companies like Bito use dividend history to show financial stability and attract long-term investors. For beginners, knowing Bito dividend history is important because it tells you how often dividends are paid and if they have increased over time.

Investors can find Bito dividend history on official reports, stock market websites, or financial news portals. It is a simple way to check if Bito rewards shareholders consistently. A strong dividend history often indicates that a company is healthy and confident about future profits.

Year-by-Year Breakdown of Bito Dividend History

Looking at Bito dividend history year by year helps investors see trends. For example:

- Early Years: Bito started with small dividend payments.

- Growth Years: As profits increased, dividends also rose gradually.

- Recent Years: Bito shows a pattern of consistent payouts, sometimes with small increases.

This year-by-year review shows investors how Bito managed its profits and rewarded shareholders. It is also helpful for predicting future payouts based on past trends.

Why Bito Dividend History Matters

Bito dividend history is important because it shows the company’s commitment to its investors. Companies that maintain consistent dividends are often considered more reliable. Investors use Bito dividend history to:

- Estimate Future Income: Knowing past dividends helps plan for regular earnings.

- Assess Stability: Consistent payouts indicate financial strength.

- Compare Investments: Dividend history helps choose between different stocks or ETFs.

By understanding Bito dividend history, investors can make informed choices without relying on guesswork.

Trends and Patterns in Bito Dividend History

When studying Bito dividend history, certain trends become clear:

- Dividends tend to increase during years of strong profits.

- Occasionally, Bito may reduce or pause dividends during economic challenges.

- Long-term growth in dividends shows the company is confident in its future earnings.

Recognizing these patterns can help investors anticipate changes and decide whether Bito fits their financial goals.

Bito Dividend History vs. Other Investments

Comparing Bito dividend history with other stocks or ETFs gives a better perspective. Some companies pay higher dividends but less consistently. Others may increase dividends steadily but start lower. Bito dividend history often shows a balance of consistency and growth, making it a potential choice for cautious investors who value long-term stability.

By comparing Bito dividend history with other options, investors can select investments that match their income expectations and risk tolerance.

Tips for Using Bito Dividend History

Here are some practical tips to use Bito dividend history effectively:

- Track Annual Payouts: Look at how dividends have changed over the years.

- Check Dividend Yield: Compare the dividend to Bito’s current stock price.

- Look for Special Dividends: Sometimes, Bito may give extra payouts in profitable years.

- Use for Planning: Estimate future income from dividends to support financial planning.

Following these tips helps investors make better decisions using Bito dividend history.

Risks to Consider

While Bito dividend history is helpful, it doesn’t guarantee future payments. Economic changes, company performance, or industry challenges can affect dividends. Investors should combine dividend history with other research, like financial statements and market trends, to make safe choices.

Remember, a strong past dividend history shows potential, but careful monitoring is still necessary.

Conclusion

Studying Bito dividend history is an important step for any investor. It provides insights into company performance, consistency, and shareholder rewards. Using this knowledge, investors can plan for income, compare with other options, and make informed decisions. However, dividend history should be one of many factors in evaluating Bito as an investment.

FAQs

Q1: How often does Bito pay dividends?

A: Bito usually pays dividends quarterly or annually. The exact frequency is shown in Bito dividend history.

Q2: Can past dividend history predict future payments?

A: Past dividends show trends but do not guarantee future payments. Economic and business factors may change payouts.

Q3: Where can I find Bito dividend history?

A: You can check official reports, stock market websites, or financial news portals for Bito dividend history.

Q4: Is a higher dividend better?

A: Not always. Consistency and growth over time are more important than a one-time high payout.

Q5: How does Bito dividend history help investors?

A: It helps estimate future income, assess stability, and compare Bito with other investments.